With Trudeau leading this does not surprise me. Of all G7 countries Canada has the highest debt loads. Even with the BOC raising interest rates, it is doing little to curb inflation due to Trudeau's mass immigration policy. Rapid artificial population growth ensures that demand keeps on increasing but supply remains the same, the result is higher and higher inflation. Housing is the perfect example, prices continue to rise. Also for several years interest rates on mortgages were very low, so that with rapid population increases = skyrocketing prices. It does not take a rocket scientist to realize this, if you got more people and the amount of product or services to sell the investors will jack up prices. We see this everywhere in every aspect of our lives including the escorts, prices are going up but the demand does not slow down. Grocery prices keep on rising even faster, grocery stores have the upper hand because there are just so many people, with so many people there will always be people willing to buy overprices food further enhancing inflation. Rapid population increase has increased the gap between the rich and poor. Investors, corporations, and landlords are profiting big time while the average joe keeps on getting poorer. Salaries remain stagnant for most folks. The government benefits a lot from inflation, they are racking in lots of profits by devaluing the currency.

Explore the adverse effects of Canada's mass immigration policy on carbon emissions, housing, inequality, and more. Understand the long-term repercussions and the need for sustainable strategies

sustainablesociety.com

Direct Quote from Article:

Housing inflation and increasing levels of debt are the consequences of having added 10 million people plus over 3 million housing units over the past 50 years of mass immigration in Canada. Combined with the impact of huge inflows of cheap labour, this creates the perfect engine of inequality.

In fact, Canada’s equality level has fallen from the second highest in the world in the early 1960s to the mid 20’s currently, a decline unmatched by any other developed country in the world. By causing overpopulation, immigration creates many other problems.

The housing demand created by an additional 10 million people has pushed up the cost of housing since it is responsible for 80% of new additional housing demand across the country. Mass immigration is responsible for 100% of housing demand in most cities in Canada, as there is a net outflow of Canadians from these large urban centres.

Explore the housing crisis in Canada, understanding the factors behind unaffordable homes. Discover why immigration plays a crucial role and the need for sustainable policies

sustainablesociety.com

Direct Quote from Article:

Interest rates are the same across the country and in low demand areas, very nice 1400 sq. ft. homes on nice lots in good neighbourhoods can be purchased for well under $200,000. In the areas whose populations are being swelled by massive levels of immigration, such houses would demand well over $1 million. Despite media denial or stonewalling, demand drives prices. Housing inflation is not the mystery the media make it out to be. What causes house prices to rise? Demand. What causes demand to grow? Immigration.

This is what 8 years of Trudeau did. Before Trudeau, a 3 1/2 apartment in Toronto can be had for $1100, after 5 years of Trudeau that same apartment is going for $2200. Many people are not too far from being homeless.

Lastly the covid scam was another game changer, for two years Trudeau handed out free money to many businesses, landlords, and also his ridiculous CERB for over two years. All these people got free money to spend, currency essentially created out of thin air. That is a recipe to devalue the currency and people will spend because it is money they did not earn causing even more inflation. Remember this is all government manufactured and by far-left government policies.

Another thing that is driving up inflation higher, is Trudeau's scam carbon tax and Clean Energy Act. By making energy more expensive, you are essentially driving up inflation even higher. One way to combat inflation is to have abundant cheap energy, but that is not part of Trudeau's policy.

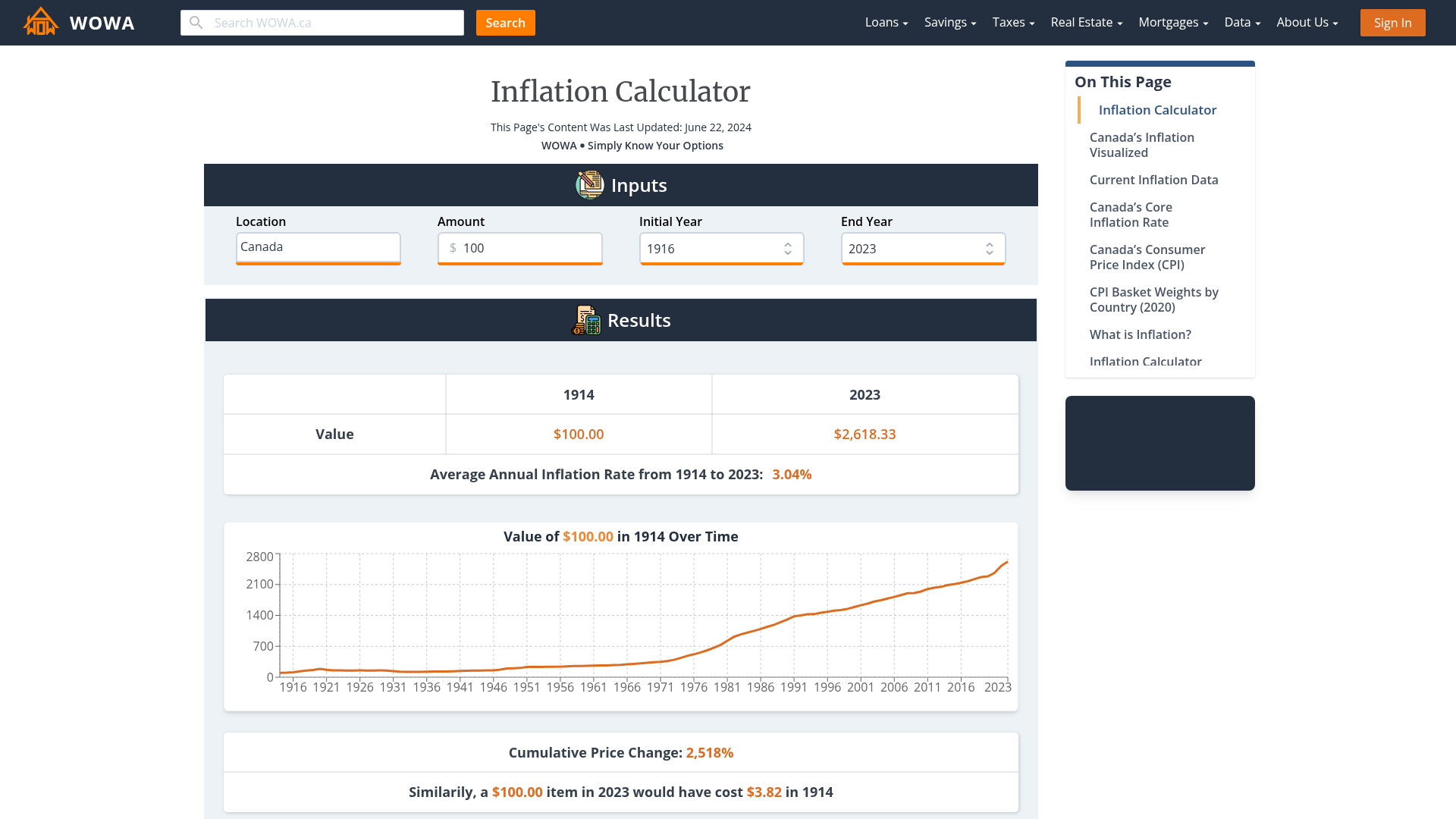

wowa.ca

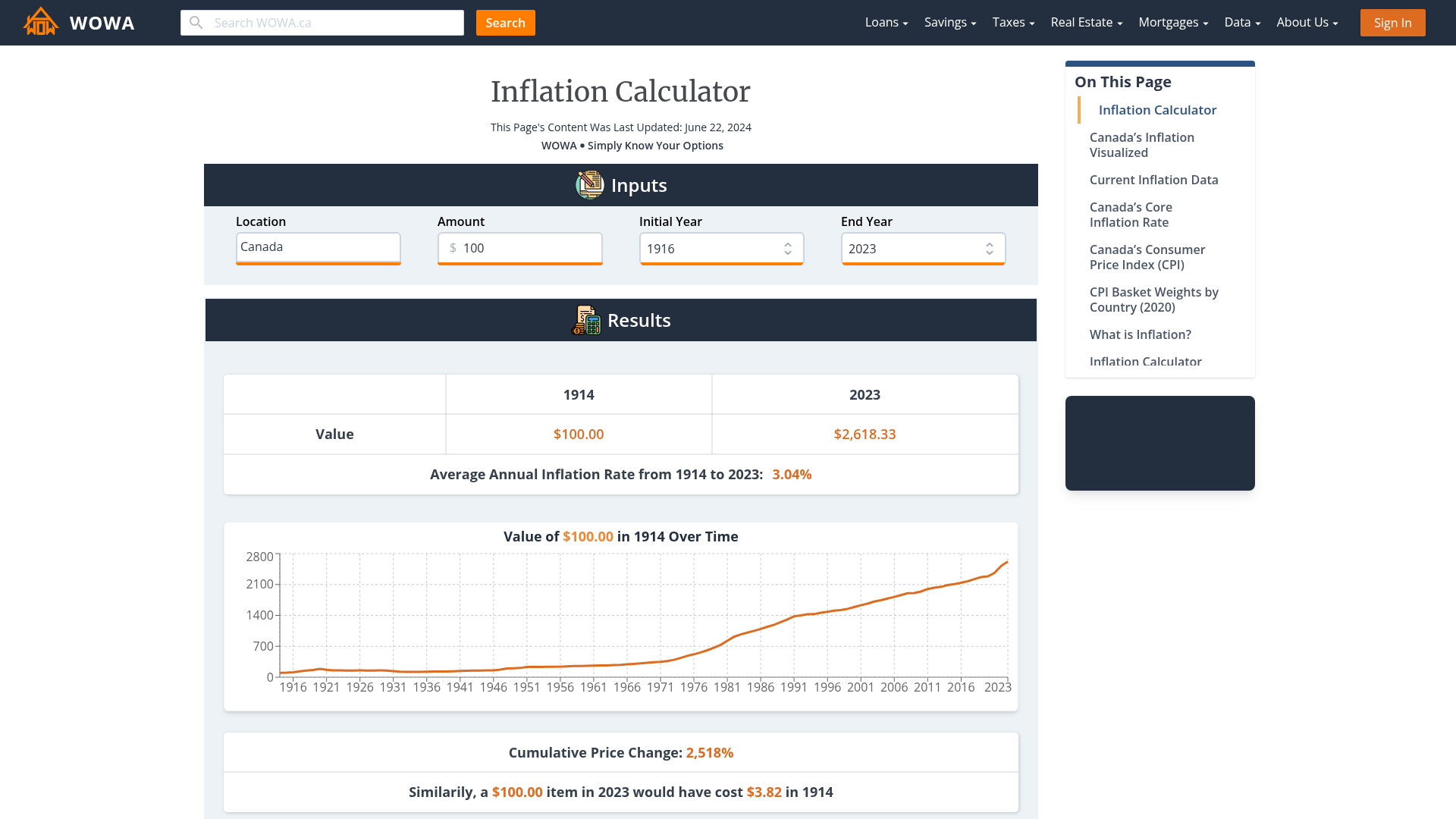

wowa.ca