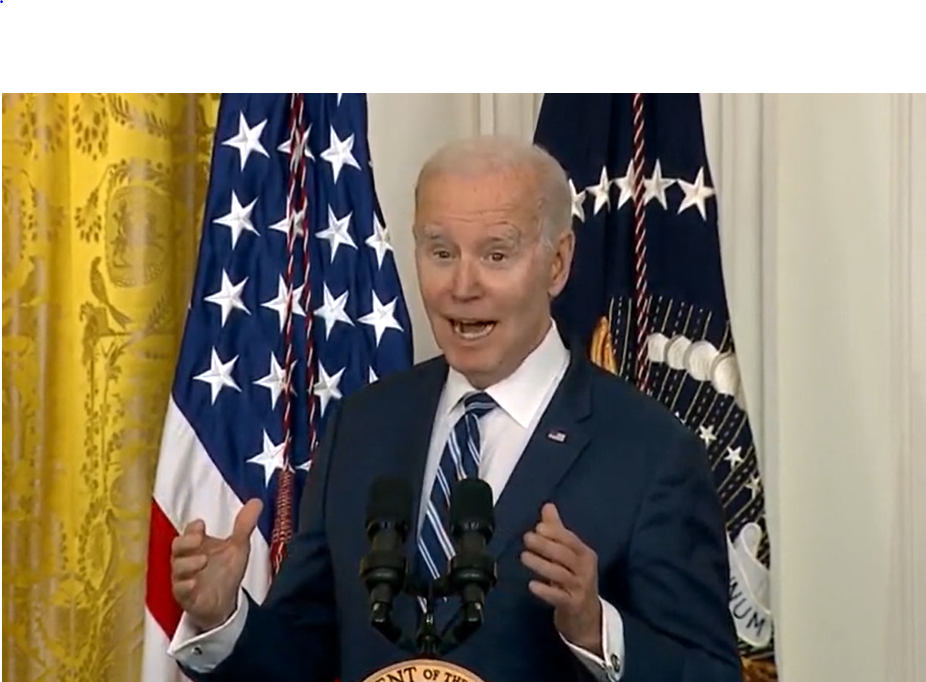

President Biden loves to take credit where it isn’t due. His latest?

“Thanks to the quick action of my administration over the last few days, Americans can have confidence that the banking system is safe,”

the prez smugged Monday morning of his administration’s extraordinary move Sunday to make whole the depositors of Silicon Valley Bank, far above FDIC-insured amounts, to head off possible systemic failures.

First, it’s been

less than two days — far too soon to see if

the wider danger is over.

Worse, this “Joe to the rescue” schtick is completely disingenuous. Biden’s dismal economic leadership

got us here.

He dumped trillions into an economy already running hot in 2021. When inflation headed for the stratosphere, the White House first dismissed it as “transitory,” then insanely tried to pin the biggest blame on Russian President Vladimir Putin and greedy corporations for the price hikes punishing everyday Americans.

The resultant rate hikes as the Federal Reserve moved belatedly and aggressively to tame inflation cratered the value of SVB’s “safe” long-maturity investments; when withdrawals forced premature liquidations, the overextended bank (yes, SVB management shares the blame too) was finished.

Meanwhile, Biden’s Treasury secretary has been busy trying to negotiate a global deal for higher taxes worldwide, while his other financial regulators have focused on pushing social justice priorities (including his energy price-hiking “climate change” agenda) in the corporate world.

One sign of just how skewed priorities have grown: Team Biden is

encouraging retirement plan managers to use woke metrics for investments, rather than seeking the best returns.

And SVB listened. The bank committed some $5 billion to back “sustainable finance and carbon neutral operations” in 2022; one of its risk-management

honchos spent her time launching Pride Month celebrations as her employer rushed toward the cliff edge.

That — and the fact that many of its depositors are tech firms that overwhelmingly give to Dems — accounts for how swiftly Biden moved to aid them. Those are the “small businesses” he vows to protect.

This bailout will devour a massive piece of the FDIC’s insurance fund; the cost of replenishing it will fall on

other banks. And guess who pays

then? Average consumers, via hiked service fees.

Biden (before jetting off to a West Coast fundraiser) demanded that Americans look at these bank failures in the “broader context.”

Please do: The correct “context” is that this is largely the result of

Biden’s preferred economic policies.